See? 34+ Truths About Chain Ladder Method Your Friends Forgot to Share You.

Chain Ladder Method | From wikipedia, the free encyclopedia. Chain ladder method is a statistical method of estimating outstanding claims, whereby the weighted average of past claim development is projected into the future. Statistical methods for the chain ladder technique. The method of bootstrapping stochastic chain ladder models can be seen in a number of different. Abstract this paper considers the application of loglinear models to claims reserving.

The chain ladder method is a means for insurers to determine how much they need to keep on reserve to cover future claims made by their insureds (members). Abstract this paper considers the application of loglinear models to claims reserving. The chain ladder method is used by insurers to forecast. Underpinning of methods such as the chain ladder technique. Abstract mack (1993) 2 and murphy (1994) 4 derived analytic formulas for the reserve risk of the chain ladder method.

The method of bootstrapping stochastic chain ladder models can be seen in a number of different. The chain ladder method is a popular technique to estimate the future reserves needed to handle claims that are not fully settled. The chain ladder method (clm) is a method for computing the claims reserve requirement in an insurance company's financial statement. The chain ladder method is used to forecast the amount of reserves that must be established in order to cover future claims. From wikipedia, the free encyclopedia. Chain ladder method is a statistical method of estimating outstanding claims, whereby the weighted average of past claim development is projected into the future. The incremental loss ratio method section 3: Background—from laddering to the means end chain. The colleague estimates thefollowing models The chain ladder method is a means for insurers to determine how much they need to keep on reserve to cover future claims made by their insureds (members). Abstract this paper considers the application of loglinear models to claims reserving. Chain ladder reserve risk estimators. Statistical methods for the chain ladder technique.

Background—from laddering to the means end chain. Since the predictions of the aggregate portfolio. The incremental loss ratio method section 3: The chain ladder method (clm) is a method for computing the claims reserve requirement in an insurance company's financial statement. The colleague estimates thefollowing models

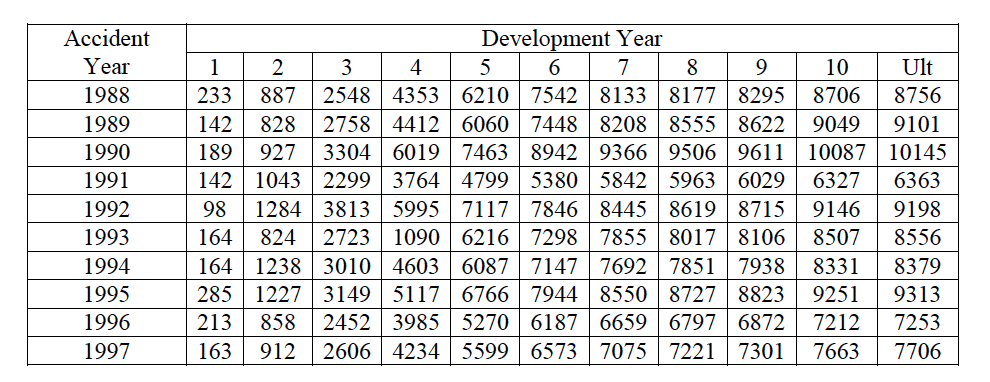

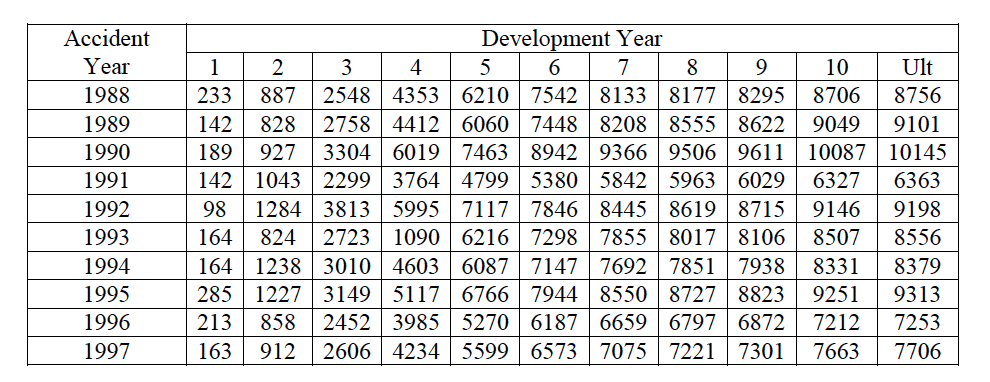

The chain ladder technique has been applied to the data in table 2, in order to estimate the numbers of ibnr claims. Chain ladder reserve risk estimators. The chain ladder method is used to forecast the amount of reserves that must be established in order to cover future claims. Background—from laddering to the means end chain. Underpinning of methods such as the chain ladder technique. Further down a practical introduction to actuarial data quality. The incremental loss ratio method section 3: The chain ladder method (clm) is a method for computing the claims reserve requirement in an insurance company's financial statement. Clinical psychologists first introduced the laddering technique in the 1960s, as a method of understanding people's core values and beliefs. The chain ladder method is a means for insurers to determine how much they need to keep on reserve to cover future claims made by their insureds (members). Abstract this paper considers the application of loglinear models to claims reserving. The colleague estimates thefollowing models The method of bootstrapping stochastic chain ladder models can be seen in a number of different.

Chain ladder reserve risk estimators. Loss development factor fitting and cape cod models. From wikipedia, the free encyclopedia. Its intent is to estimate incurred but not reported claims and project ultimate loss amounts. We define a time series model for the chain ladder.

We define a time series model for the chain ladder. The chain ladder method is a means for insurers to determine how much they need to keep on reserve to cover future claims made by their insureds (members). Abstract mack (1993) 2 and murphy (1994) 4 derived analytic formulas for the reserve risk of the chain ladder method. Chain ladder reserve risk estimators. Clinical psychologists first introduced the laddering technique in the 1960s, as a method of understanding people's core values and beliefs. Its intent is to estimate incurred but not reported claims and project ultimate loss amounts. Abstract this paper considers the application of loglinear models to claims reserving. The chain ladder technique has been applied to the data in table 2, in order to estimate the numbers of ibnr claims. The colleague estimates thefollowing models Statistical methods for the chain ladder technique. The chain ladder method is a popular technique to estimate the future reserves needed to handle claims that are not fully settled. I'll be extremely happy if this helps even a single person out there! The chain ladder method (clm) is a method for computing the claims reserve requirement in an insurance company's financial statement.

Chain Ladder Method: Chain ladder reserve risk estimators.

Source: Chain Ladder Method